Protecting Entire Communities

Capital formation & technology for wildfire coverage

Parametric Insurance for Community-Wide Coverage

Definitions:

Community Coverage

Pooling property owners within a community to create purchasing power and access to better policy structures such as a parametric insurance

+

Parametric Insurance

Policy based on an objective, measurable event (i.e., a parameter), regardless of the actual loss. This enables automatic and nearly instant financial payout

Why Community Coverage?

Unlike other natural disasters like earthquakes or hurricanes, wildfires require mitigation at a community scale to be effective in saving property, lives, and insurance costs

An unprotected property amidst ones that have taken complete risk mitigation steps is fuel for a wildfire and makes everyone vulnerable

Imagine

for Property Owners and Small Businesses

Automatic payouts—no claims battles

Complete coverage, no gaps

Eliminate financial risk of a disaster

Institutional pricing power for coverage

Everyone financially motivated to reduce wildfire risk

Imagine

for Community Leaders

Enables municipalities to de-risk their entire fiscal future

Recovery capital flowing instantly, not months later

Universal fire-safety participation

Zero coverage gaps across all properties

Economic protection for vulnerable residents

Incentive?

Insurance and Mitigation Enable Each Other

-63%

Property Destroyed

-55%

Lower Premiums

For Communities

Protect your community by pooling wildfire risk into a single legal entity—aligning incentives for effective mitigation while providing greater purchasing power and access to innovative, customizable coverage.

Complete Coverage

No gaps in policy coverage that leave communities vulnerable during disasters.

Immediate and Automatic Payouts

Policy trigger is measurable and objective and activates payouts automatically

Community Control

Local governance and decision-making determines the policy coverage details

Risk Reduction

Financial and communal incentive to harden homes and create defensible space

Financial Protection Guaranteed

Catastrophe Bond structure guarantees disaster funding is safe and easily deployed

For Investors

Directly access underwriting opportunities that didn't previously exist—when communities pool their wildfire risk, they create the financial alignment needed to incentivize collective mitigation, making previously uninsurable risk investable.

Cat Bond Structure

Familiar structure with major custody agents and well tested legal wrappers

Direct Access to Opportunities

Frontline opportunities that bypass intermediaries

Scaled Model

Single buyer at the size and scale to which institutional investors are accustomed

Lacks Adverse Selection

Risk represents an entire community versus individual high risk locations and properties

Lacks Moral Hazard

Financial and social incentives ensure hardening and defensive space are complete

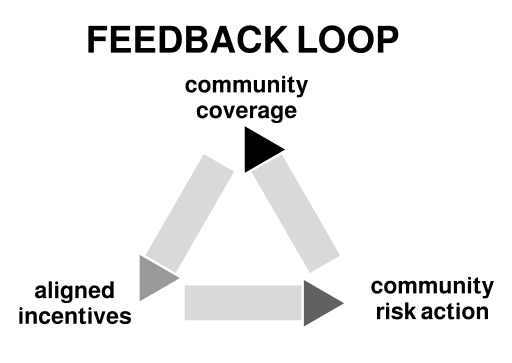

The Problem: Effective Risk Mitigation Lacks Aligned Community Incentives

Although home hardening and defensible space can reduce wildfire risk by half, communities aren't implementing these measures comprehensively. Individual homeowners lack the financial incentive to invest in mitigation when their efforts depend on neighbors doing the same—and this coordination failure makes comprehensive coverage difficult to underwrite and price.

“While applying these measures to any particular structure within a dense urban area makes little difference on the survivability of a single home, substantial reductions in losses are achievable when community-wide actions can be applied.”

UC Berkeley Fire Research Lab

The Problem - Standard Policies Are Not Designed for Natural Disasters

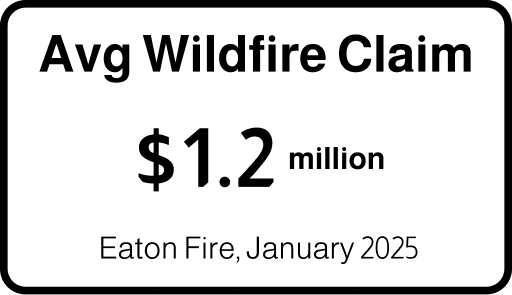

Property & Casualty insurers traditionally built their business models around frequent, small claims where standard claims processing timelines are sufficient. Wildfire catastrophes are fundamentally different: they're infrequent, severe, affect entire communities simultaneously, and demand very large and immediate liquidity for emergency housing and rebuilding.

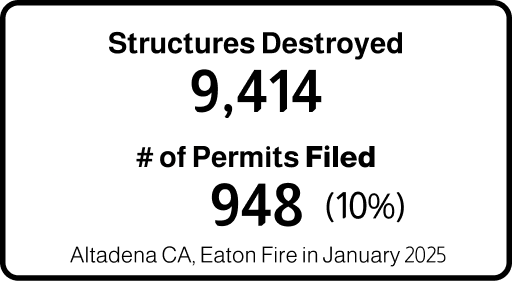

The Problem - Slow Money Flow Delays Rebuilding

Rebuilding times are long - very long. Some communities never recover. Recent data suggests that some communities have achieved 25% rebuild after two years and 58% after 4-6 years. Altadena CA, now 9 months post Eaton fire, has barely gotten started. Accessing financial resources and knowing the amount available to rebuild are critical variables for recovery to begin.

The Solution - Community Coverage Fills the Gaps

Financial incentive created to take risk reducing action (policy underwriting ability and cost will require it)

Social incentive created

Event payout is automatic and immediate

Payout amounts meet the needs of the community

Community designs policy terms to ensure completeness

Eliminates the “free-rider” problem (property owners that don’t invest in risk mitigation placing everyone in the community at-risk)

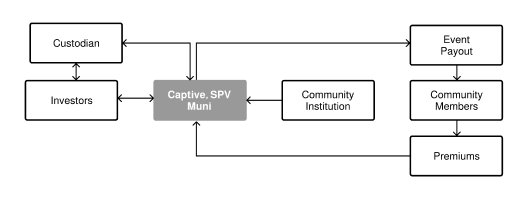

Communities Gain Direct Access to Institutional Investors and Reinsurers

Communities that aggregate their risk gain a direct pathway to advanced wildfire insurance solutions from the main entities that take on catastrophe risk. Further, a community policy creates scale in pricing. Investors also gain by having access to well defined opportunities, the absence of moral hazard and adverse selection, and a cat bond structure.

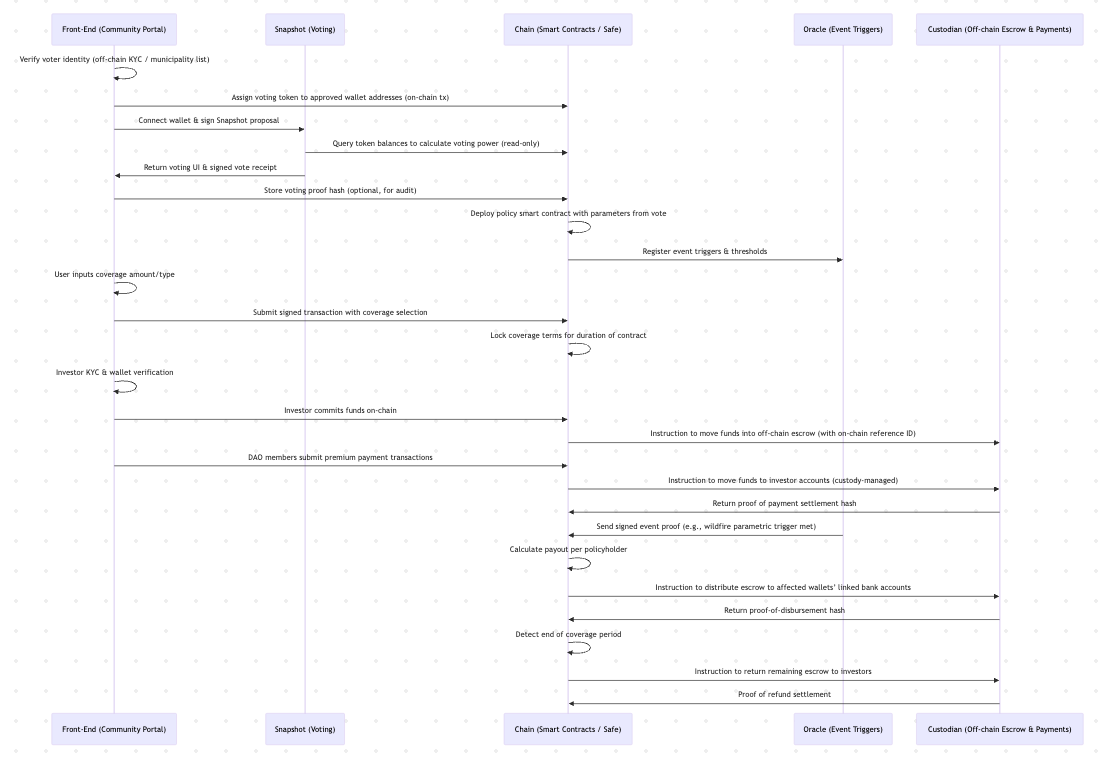

How it Works for Communities

Technology platform manages a community’s policy creation via a polling and voting mechanism, encodes the decisions into software, and manages the administration of cover payments and event payouts

How it Works for Investors

Investors will interact with the community’s legal entity, place bond proceeds into custody, and receive bond payments into the same custodian.

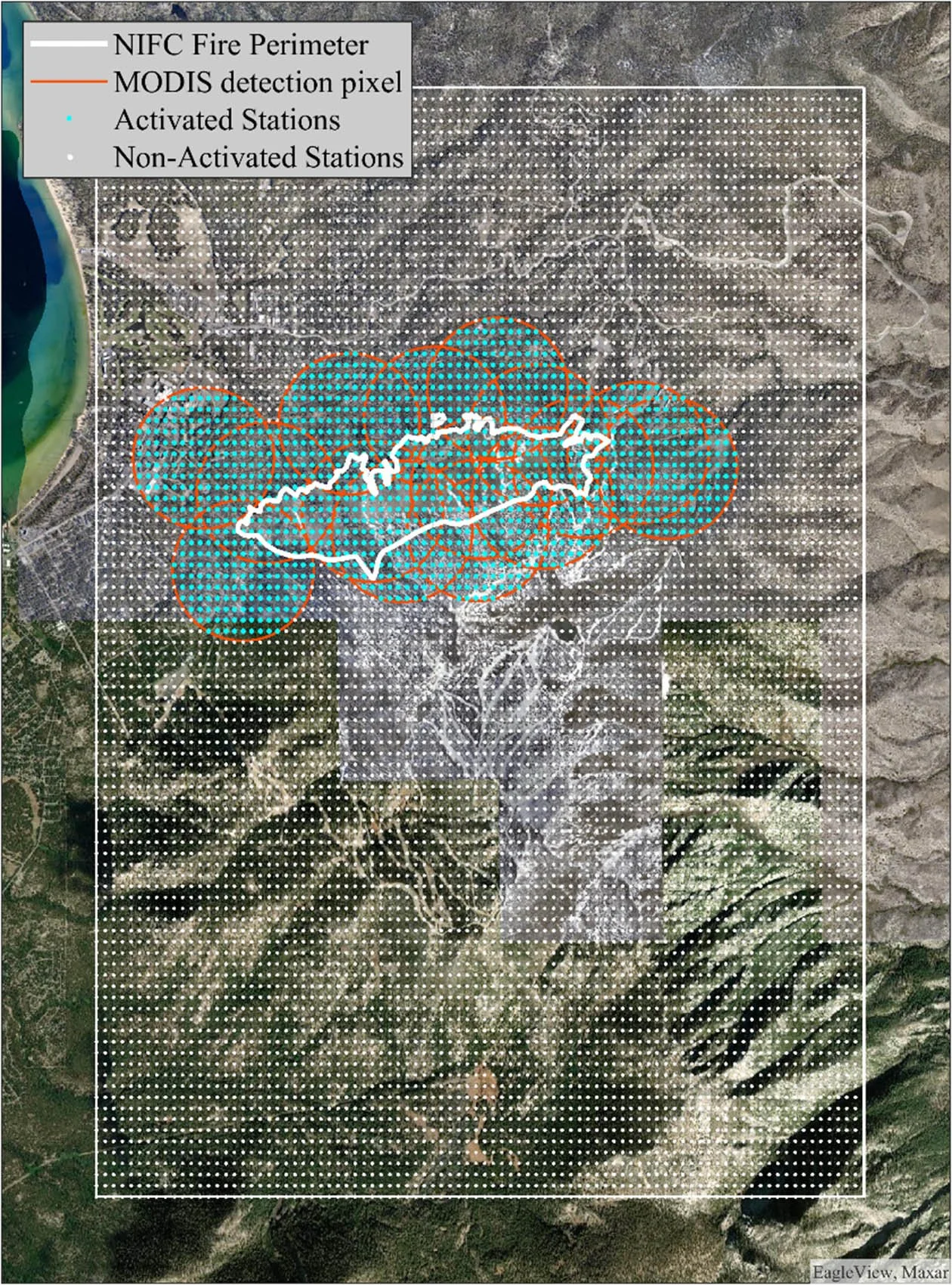

Automated Payout

Sensor, camera, and satellite data feed into the technology to monitor conditions. Once a threshold is passed, event payment is automatically triggered.

Transparent Process

All parties understand and can audit the process for decisions, actions, and money flow.

How it Works

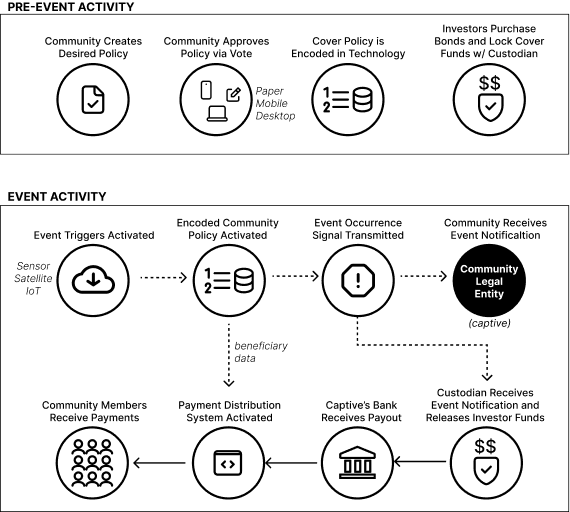

Trigger - The community selected triggers activates an event signal

Cover Policy - The encoded policy, determined and approved by the community, processes the trigger signal to determine the payout

Signal Transmission - Signal is sent to the community’s legal entity (captive) and to the custodian of investors capital

Custodian Releases Funds - Escrowed capital is released to the community’s bank

Bank Receives Cover Funds

Payment Distribution - The bank releases funds to a payment distribution system that has the specific details of specific community members and destination banking information

Community Members Receive Coverage Payment

About our company

BoxedCover structures and finances wildfire protection for entire communities by creating direct capital pathways between institutional investors and wildfire-vulnerable areas.

Our platform empowers communities—HOAs, neighborhood associations, municipalities—to design their own protection. Community members define coverage parameters, establish objective payout triggers, designate beneficiaries, and encode these decisions into immutable software. The platform then autonomously administers real-time capital flows, eliminating intermediaries.

BoxedCover makes wildfire protection more accessible, transparent, and efficient for the communities that need it most

Contact Us

Interested in working together? Fill out some info and we will be in touch shortly. We can’t wait to hear from you!